datetime.date(2006, 1, 1)

datetime.date.today()

finance.fetch_historical_yahoo(ticker, startdate, enddate)

mlab.csv2rec(fh)

fh.close()

r.sort()

np.asarray(x)

np.ones(n)

weights.sum()

np.convolve(x, weights, mode='full')[:len(x)]

np.diff(prices)

np.zeros_like(prices)

...

Command:

$ cat Downloads/finance_work2.py

Result:

import datetime

import numpy as np

import matplotlib.colors as colors

import matplotlib.finance as finance

import matplotlib.dates as mdates

import matplotlib.ticker as mticker

import matplotlib.mlab as mlab

import matplotlib.pyplot as plt

import matplotlib.font_manager as font_manager

plt.style.use('dark_background')

startdate = datetime.date(2006, 1, 1)

today = enddate = datetime.date.today()

ticker = 'SPY'

fh = finance.fetch_historical_yahoo(ticker, startdate, enddate)

# a numpy record array with fields: date, open, high, low, close, volume, adj_close)

r = mlab.csv2rec(fh)

fh.close()

r.sort()

def moving_average(x, n, type='simple'):

"""

compute an n period moving average.

type is 'simple' | 'exponential'

"""

x = np.asarray(x)

if type == 'simple':

weights = np.ones(n)

else:

weights = np.exp(np.linspace(-1., 0., n))

weights /= weights.sum()

a = np.convolve(x, weights, mode='full')[:len(x)]

a[:n] = a[n]

return a

def relative_strength(prices, n=14):

"""

compute the n period relative strength indicator

http://stockcharts.com/school/doku.php?id=chart_school:glossary_r#relativestrengthindex

http://www.investopedia.com/terms/r/rsi.asp

"""

deltas = np.diff(prices)

seed = deltas[:n+1]

up = seed[seed >= 0].sum()/n

down = -seed[seed < 0].sum()/n

rs = up/down

rsi = np.zeros_like(prices)

rsi[:n] = 100. - 100./(1. + rs)

for i in range(n, len(prices)):

delta = deltas[i - 1] # cause the diff is 1 shorter

if delta > 0:

upval = delta

downval = 0.

else:

upval = 0.

downval = -delta

up = (up*(n - 1) + upval)/n

down = (down*(n - 1) + downval)/n

rs = up/down

rsi[i] = 100. - 100./(1. + rs)

return rsi

def moving_average_convergence(x, nslow=26, nfast=12):

"""

compute the MACD (Moving Average Convergence/Divergence) using a fast and slow exponential moving avg'

return value is emaslow, emafast, macd which are len(x) arrays

"""

emaslow = moving_average(x, nslow, type='exponential')

emafast = moving_average(x, nfast, type='exponential')

return emaslow, emafast, emafast - emaslow

plt.rc('axes', grid=True)

plt.rc('grid', color='0.75', linestyle='-', linewidth=0.5)

textsize = 9

left, width = 0.1, 0.8

rect1 = [left, 0.7, width, 0.2]

rect2 = [left, 0.3, width, 0.4]

rect3 = [left, 0.1, width, 0.2]

fig = plt.figure(facecolor='white')

axescolor = '#f6f6f6' # the axes background color

ax1 = fig.add_axes(rect1, axisbg=axescolor) # left, bottom, width, height

ax2 = fig.add_axes(rect2, axisbg=axescolor, sharex=ax1)

ax2t = ax2.twinx()

ax3 = fig.add_axes(rect3, axisbg=axescolor, sharex=ax1)

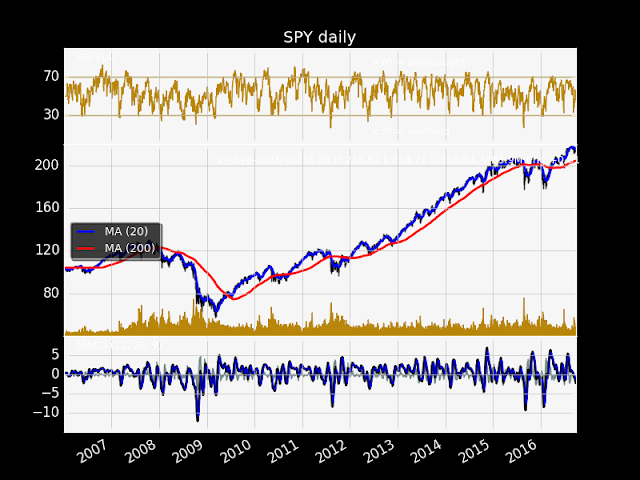

# plot the relative strength indicator

prices = r.adj_close

rsi = relative_strength(prices)

fillcolor = 'darkgoldenrod'

ax1.plot(r.date, rsi, color=fillcolor)

ax1.axhline(70, color=fillcolor)

ax1.axhline(30, color=fillcolor)

ax1.fill_between(r.date, rsi, 70, where=(rsi >= 70), facecolor=fillcolor, edgecolor=fillcolor)

ax1.fill_between(r.date, rsi, 30, where=(rsi <= 30), facecolor=fillcolor, edgecolor=fillcolor)

ax1.text(0.6, 0.9, '>70 = overbought', va='top', transform=ax1.transAxes, fontsize=textsize)

ax1.text(0.6, 0.1, '<30 = oversold', transform=ax1.transAxes, fontsize=textsize)

ax1.set_ylim(0, 100)

ax1.set_yticks([30, 70])

ax1.text(0.025, 0.95, 'RSI (14)', va='top', transform=ax1.transAxes, fontsize=textsize)

ax1.set_title('%s daily' % ticker)

# plot the price and volume data

dx = r.adj_close - r.close

low = r.low + dx

high = r.high + dx

deltas = np.zeros_like(prices)

deltas[1:] = np.diff(prices)

up = deltas > 0

ax2.vlines(r.date[up], low[up], high[up], color='black', label='_nolegend_')

ax2.vlines(r.date[~up], low[~up], high[~up], color='black', label='_nolegend_')

ma20 = moving_average(prices, 20, type='simple')

ma200 = moving_average(prices, 200, type='simple')

linema20, = ax2.plot(r.date, ma20, color='blue', lw=2, label='MA (20)')

linema200, = ax2.plot(r.date, ma200, color='red', lw=2, label='MA (200)')

last = r[-1]

s = '%s O:%1.2f H:%1.2f L:%1.2f C:%1.2f, V:%1.1fM Chg:%+1.2f' % (

today.strftime('%d-%b-%Y'),

last.open, last.high,

last.low, last.close,

last.volume*1e-6,

last.close - last.open)

t4 = ax2.text(0.3, 0.9, s, transform=ax2.transAxes, fontsize=textsize)

props = font_manager.FontProperties(size=10)

leg = ax2.legend(loc='center left', shadow=True, fancybox=True, prop=props)

leg.get_frame().set_alpha(0.5)

volume = (r.close*r.volume)/1e6 # dollar volume in millions

vmax = volume.max()

poly = ax2t.fill_between(r.date, volume, 0, label='Volume', facecolor=fillcolor, edgecolor=fillcolor)

ax2t.set_ylim(0, 5*vmax)

ax2t.set_yticks([])

# compute the MACD indicator

fillcolor = 'darkslategrey'

nslow = 26

nfast = 12

nema = 9

emaslow, emafast, macd = moving_average_convergence(prices, nslow=nslow, nfast=nfast)

ema9 = moving_average(macd, nema, type='exponential')

ax3.plot(r.date, macd, color='black', lw=2)

ax3.plot(r.date, ema9, color='blue', lw=1)

ax3.fill_between(r.date, macd - ema9, 0, alpha=0.5, facecolor=fillcolor, edgecolor=fillcolor)

ax3.text(0.025, 0.95, 'MACD (%d, %d, %d)' % (nfast, nslow, nema), va='top',

transform=ax3.transAxes, fontsize=textsize)

#ax3.set_yticks([])

# turn off upper axis tick labels, rotate the lower ones, etc

for ax in ax1, ax2, ax2t, ax3:

if ax != ax3:

for label in ax.get_xticklabels():

label.set_visible(False)

else:

for label in ax.get_xticklabels():

label.set_rotation(30)

label.set_horizontalalignment('right')

ax.fmt_xdata = mdates.DateFormatter('%Y-%m-%d')

class MyLocator(mticker.MaxNLocator):

def __init__(self, *args, **kwargs):

mticker.MaxNLocator.__init__(self, *args, **kwargs)

def __call__(self, *args, **kwargs):

return mticker.MaxNLocator.__call__(self, *args, **kwargs)

# at most 5 ticks, pruning the upper and lower so they don't overlap

# with other ticks

#ax2.yaxis.set_major_locator(mticker.MaxNLocator(5, prune='both'))

#ax3.yaxis.set_major_locator(mticker.MaxNLocator(5, prune='both'))

ax2.yaxis.set_major_locator(MyLocator(5, prune='both'))

ax3.yaxis.set_major_locator(MyLocator(5, prune='both'))

plt.savefig("pyplot_finance_work2.png")

Graphical output:

|

| pyplot_finance_work2.png |